Foreign buyers flock back to U.S. home market

Buyers from other countries accounted for $56 billion in home sales between April 2024 and March 2025

Family incomes need to be nearly $100,000 annually to afford the typical home

The housing deficit grew to 4.7 million homes in 2023, according to the U.S. Census Bureau

Mortgage denial rates are nearly double for Black applicants: LendingTree

A third of all mortgage denials for Black applicants in 2024 were due to debt-to-income ratios

Homebuyers resurface as mortgage demand gains steam

Applications for purchases and refinances both increased heading into the July Fourth holiday

Home delistings spike as sellers hold out for better offers

Price cuts also soared in June: Realtor.com

Refinancing helps lift June’s rate lock volume: Optimal Blue

Lenders were busy with rate-and-term refinancing in June

Job insecurity weighs on homebuyer sentiment

Almost 30% of Fannie Mae survey respondents are worried about losing their job

Mortgage rates fall for the fifth consecutive week

The decreases are partly due to the possibility that the Federal Reserve will soon cut rates

BLS jobs report beats expectations, dampening chances of a July rate cut

Hiring trends continue to defy projections

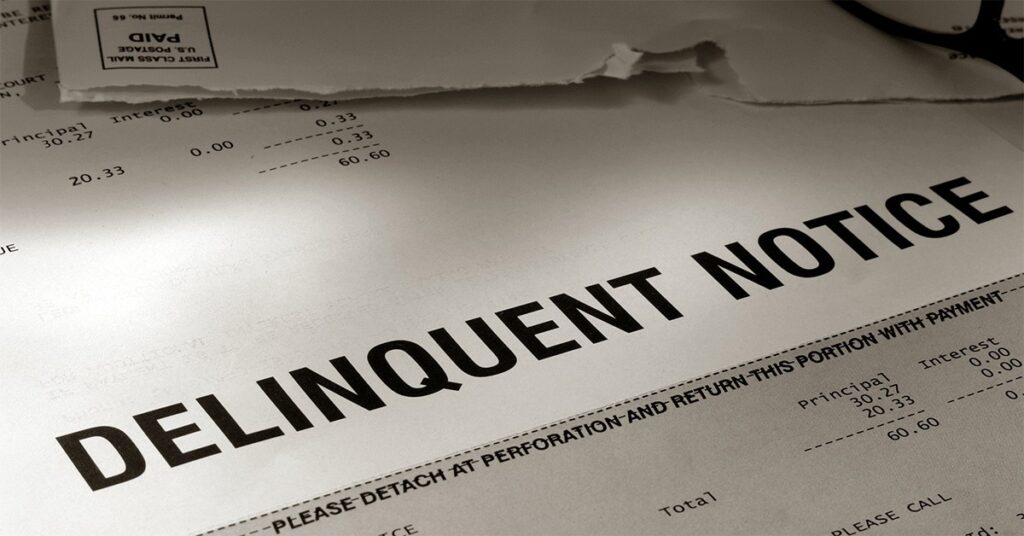

Office delinquency rate for mortgage-backed securities hits record high in June

Loan delinquency rates rose for four of the five main commercial property types